Some Known Factual Statements About Surety - Wikipedia

What Does Surety Bonds - Department of Financial Services Mean?

Common such bonds are executor and administrator bonds, trustee bonds, guardian bonds, and conservator bonds. Required by statute for particular holders of public office, to secure the public from impropriety by an official or from an official's failure to faithfully perform duties. Public main bonds included county clerk bonds, tax collector bonds, notary bonds, and treasurer bonds.

Included are a wide array of bonds, such as storage facility bonds, title bonds, energy bonds, and fuel tax bonds.

Things about Surety Bonds - RLI Corp

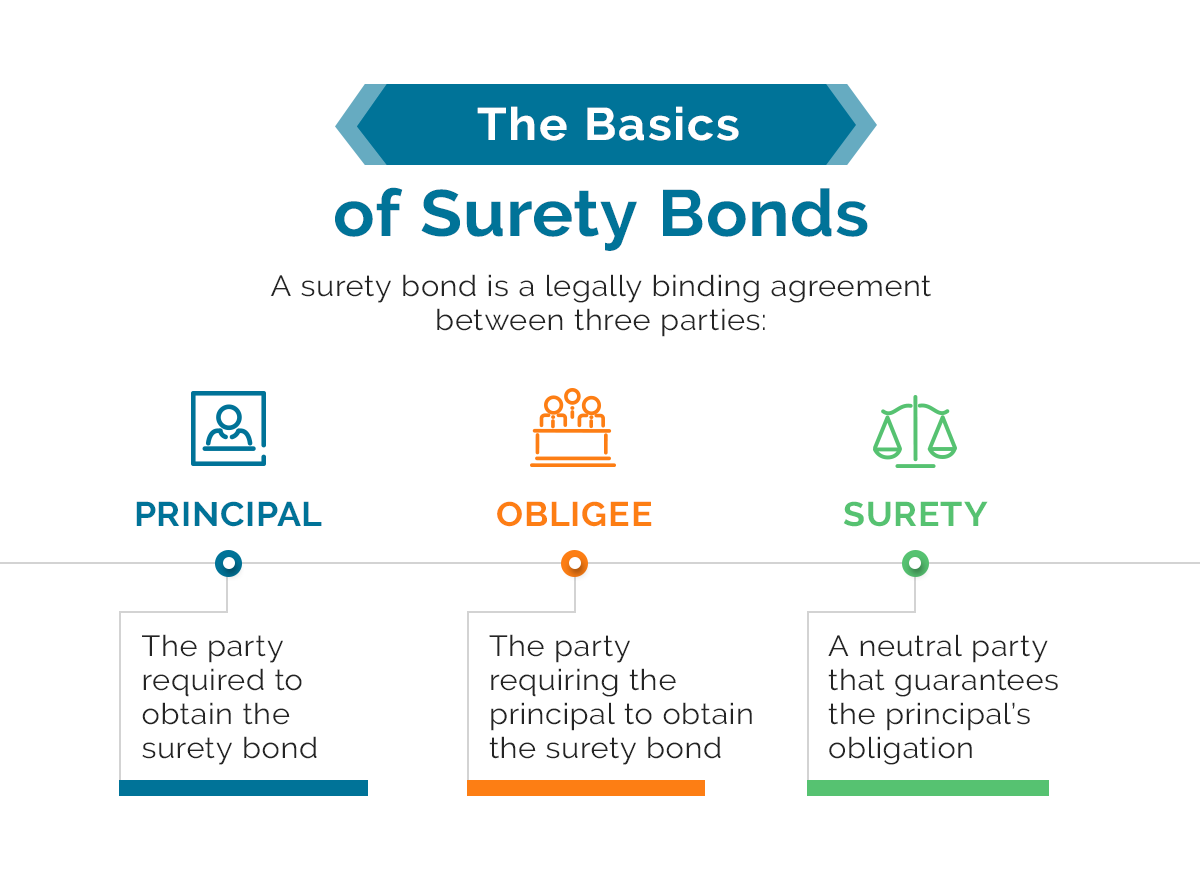

Discover the surety bond fundamentals with an easy-to-read summary of surety. You'll be an expert in no time! What Does a Surety Bond Mean? A surety bond (pronounced "- ih-tee bond") can be specified in its easiest type as a composed contract to ensure compliance, payment, or efficiency of an act.

Surety Bonds with King Insurance

What Is A Surety Bond?

The 3 parties in a surety agreement are: the celebration that purchases the bond and undertakes a responsibility to carry out a function as promised. the insurance provider or surety business that guarantees the commitment will be performed. If Full Article fails to perform the function as assured, the surety is contractually liable for losses sustained.

Bail Bonds Duluth: What Exactly is a Surety Bond?

The 25-Second Trick For Surety Bonds - San Francisco CA & Oakland CA - Barbary

For many surety bonds, the obligee is a local, state or federal government company. Surety Bond Required to Know In practice, surety bonds can have several variations to their meaning, meaning, and function depending upon the particular bond requirement. There are countless different types of surety bonds across the nation.

Other surety bonds ensure payment of tax or other monetary commitments. These bonds are described as "stringent financial warranty" bonds and many times are more expensive due to intrinsic danger of ensuring a payment as opposed to a compliance requirement. Another common type of surety bond called is described as a agreement bond.

The Ultimate Guide To What are Surety Bonds?

Specialists took part in a range of both federal government contracts and private sector work need to protect agreement bonds as needed by project owners. Most surety bonds are released for a set term (normally 1, 2, or 3 years) or they are provided as "constant" bonds. A continuous bond just means that the bond form is written so the bond is in force up until cancelled by the surety business.